Direct Debit Integration

You must be using Fred Office Plus version 5.2.24121.2 or later to use this feature.

Fred Office Plus can send and receive payment information for account customers with third-party direct debit vendors. When configured, a direct debit payment of the customer's statement balance will be scheduled to occur after a specified number of days after the statement batch has closed. Once the payment has been processed by the third-party vendor, Fred Office Plus will receive notification whether the payments were successful or not and automatically update the customer's account balance.

No customer banking information is stored within Fred Office Plus, rather it is securely handled by the direct debit vendor.

Available direct debit vendors:

-

Ezidebit

Please complete this expression of interest to get started with Ezidebit.For other general enquiries contact Ezidebit on 1300 763 256 or alternatively email support@ezidebit.com.au.

We will update this page as other direct debit vendors are onboarded. If there is a direct debit vendor you would like Fred Office Plus to integrate with, let us know by submitting a Uservoice request.

Only payments associated with your customers' monthly statements will be scheduled for direct debit. These amounts will be automatically withdrawn from your customers' accounts once the payments are cleared by the bank. The Arrangement Type should be set to On Demand when adding a new payer on the Ezidebit platform for the integration with Fred Office Plus to work.

The alternative Arrangement Type of Scheduled Debit in Ezidebit allows a set payment amount to be scheduled at a certain frequency, for example a debit of $20 per week could be charged to a customer. Scheduled Debits in Ezidebit do not integrate with Fred Office Plus so will notautomatically deduct from the customer's account. Refer to Using scheduled debits in Ezidebit for further information.

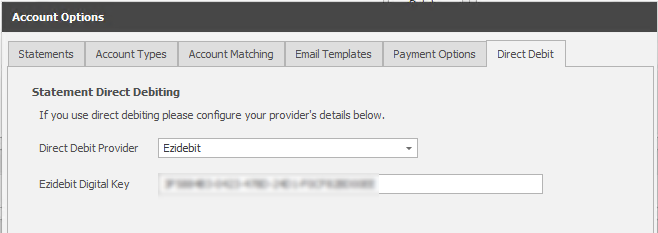

You will initially need to contact your chosen direct debit vendor to create an account with them. They will then provide you with a digital access key which needs to be loaded within Fred Office Plus.

-

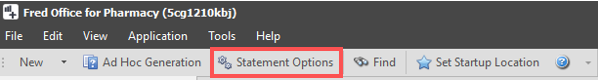

Click Contacts, then Statements.

-

Select Statement Options from the toolbar.

-

Navigate to the Direct Debit tab.

-

Select your Direct Debit Provider from the drop down list and enter the digital access key they provided.

-

Click OK to save.

-

Select Contacts, then Statements.

-

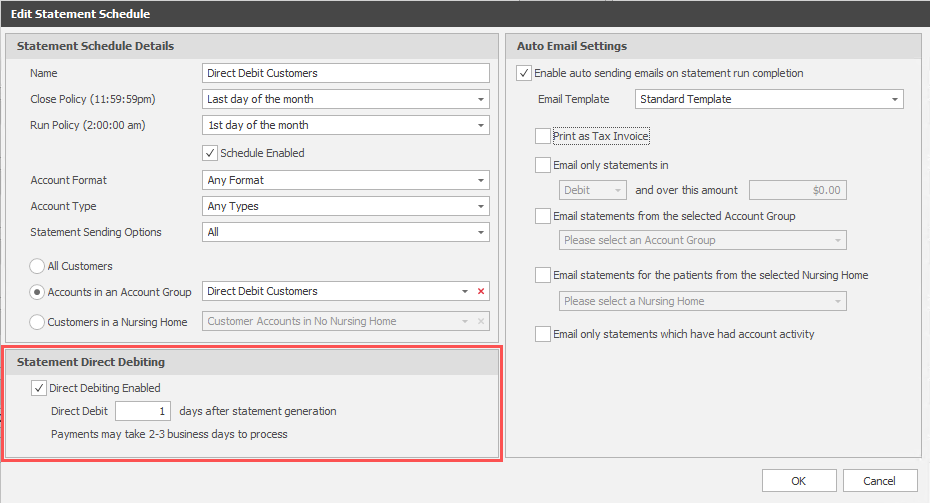

Under the Statement Schedules section, select Edit to modify your existing statement schedule.

It is recommended that you do not create a separate statement schedule for your direct debit customers, update your existing statement schedule to enable direct debits

-

Under Statement Direct Debiting, select the Direct Debiting Enabled checkbox and enter the number of days after the statement run you wish the direct debit to occur.

Payments may take another 2-3 days after this day to be processed by the bank.

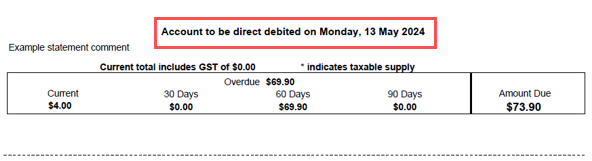

Direct debit customer statements will print with a message indicating when they will be debited:

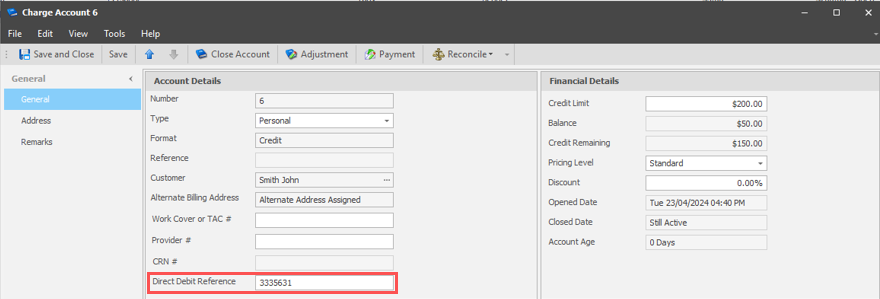

Each direct debit customer will need a reference ID which is recorded within your chosen direct debit vendor's platform. It is recommend that you use your customers' account number as this reference ID. This same direct debit reference should be entered within the Direct Debit Reference field within their account card in Fred Office Plus.

Within the Ezidebit platform the reference ID is referred to as the Client Contract Reference. When adding a new payer in Ezidebit it is important that their Arrangement Type is set On Demand for the integration to work withFred Office Plus.

-

Click on Contacts, then Accounts.

-

Search for and open the relevant account.

-

Enter the reference ID, used within the direct debit vendor's platform (in Ezidebit this is the Client Contract Ref), in the Direct Debit Reference field.

-

Click Save and Close.

To assist in managing your Direct Debit customers it is recommended that you place them into an account group. For further information see Set up and manage account groups.

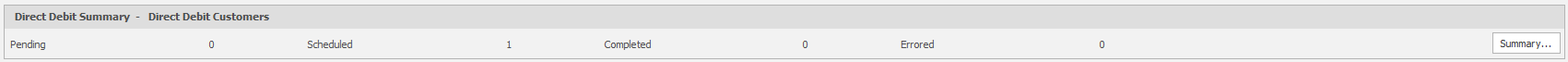

Direct Debit Summary Definitions

-

Pending: Account payments yet to be sent to the direct debit vendor.

-

Scheduled: Payments have been sent to the vendor and will be processed after the specified number of days (configured within Statement Schedule Details in Fred Office Plus).

-

Completed: Fred Office Plus has received confirmation that these payments have successfully been cleared by the bank.

-

Error: These account payments have not occurred. If there are errors Fred Office Plus will flag there are issues under the Direct Debit Issues section.

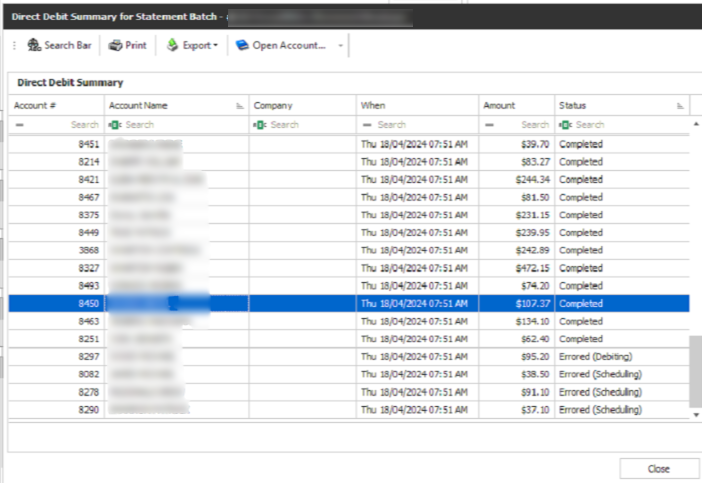

To review the Direct Debit Summary:

-

Click on Summary... to view a list of the last statement batch's direct debit customers.

-

Review any errors.

-

Error (scheduling) - payment cannot be scheduled. Check vendor portal for more information.

-

Error (debiting) - unable to process the payment. This could indicate that the customer's bank details are incorrect.

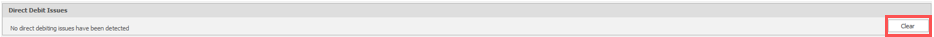

-

-

Once you have investigated and resolved all errors, from the Direct Debit Issues section, click on Clear to remove the issues flag since no further actions are required.

Scheduled debits are a feature within the Ezidebit platform that allows you to schedule regular debits from a customer's account for a fixed amount at a set frequency. For example, you might set up a $20-per-week direct debit for a customer.

It is important to note that scheduled debits in Ezidebit do not integrate with Fred Office Plus and will not automatically come off a customer's account.

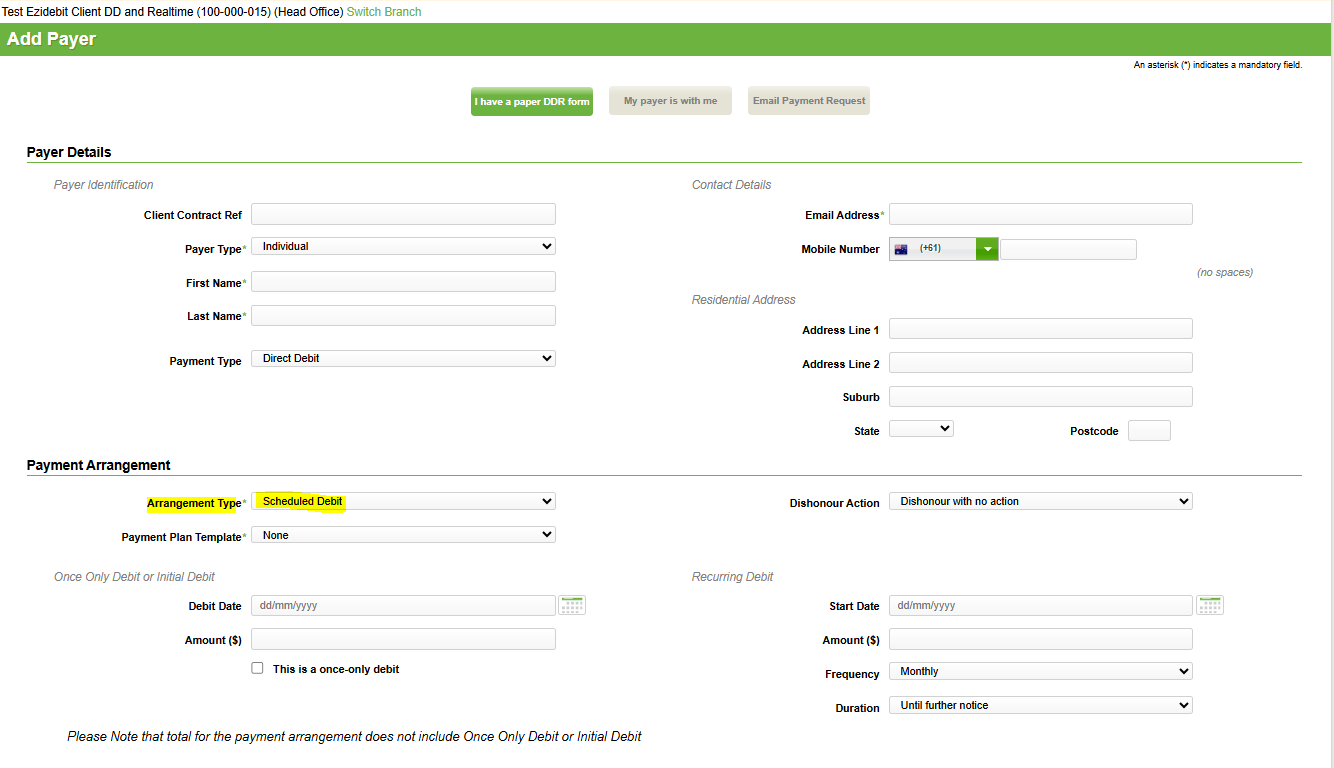

When adding a new payer to the Ezidebit platform, under the Payment Arrangement section, set the Arrangement Type to Scheduled Debit, then complete the remaining details such as Debit Date, Amount, Start date, Frequency and Duration.

As scheduled debits do not integrate with Fred Office Plus, do not enter the payer's Client Contract Ref into the Direct Debit Reference field in their Fred Office Plus account. The Direct Debit Reference field in Fred Office should only be filled when you want the customer's statement balance to be debited through Ezidebit each month.

Scheduled debits within Ezidebit will need to be manually deducted from the customer's account or applied in bulk using the Payment Importer tool.

Refer to Make an account payment or Payment Importer for more information.