Process a return for credit created from an invoice

This topic explains how to create a new Credit Note and a Return for Credit, and how to process a return for credit that was created automatically from an invoice.

- Click Ordering, then Returns.

- Right-click the return, then select Receive Credit Note.

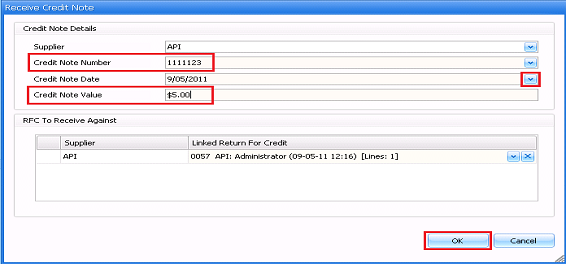

The Receive Credit Note window is displayed.

- Enter the following details:

- Credit Note Number

- Credit Note Date

-

Credit Note Value

- Click OK.

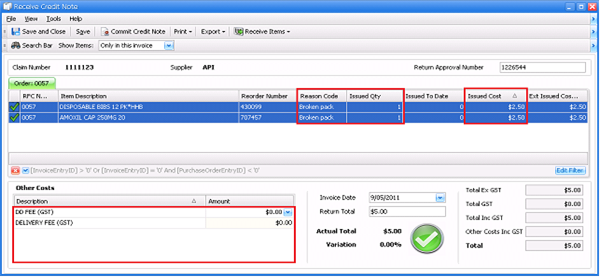

- On the Receive Credit Note screen, enter the following details, if required:

- Reason Code

- Issued Qty

- Issued Cost

-

Enter any applicable Other Costs (for example, delivery fees, DD fees, rebates).

- Click Save.

Once you have received all items and entered any other costs, the difference between the Return Total (calculated based on issued quantities and other costs figures) and the Actual Total (entered from the paper invoice) should be within the allowable variance. This is indicated with a green tick icon.

The invoice must be within the allowable variance in order to be committed. For more details, see Variance. - Click Commit Credit Note.

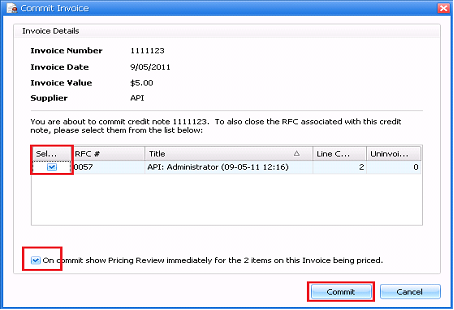

The Commit Invoice window is displayed, and shows a list of open RFCs.

If all items from an RFC were credited, there will be a tick against the RFC in the list, which means that the RFC will be closed when you commit the credit note. If further credit notes are expected for an RFC, un-tick the RFC.

If you do not want to perform Pricing Review immediately, un-tick the On Commit show Pricing Review checkbox.

- Click Commit.