Item Cost - Last or Weighted

Fred Office has two methods of calculating Item Cost:

-

Last cost (the default option) is the cost on the last received invoice

-

Weighted cost is calculated based on the current Stock On hand and cost and the new invoice's quantity and cost.

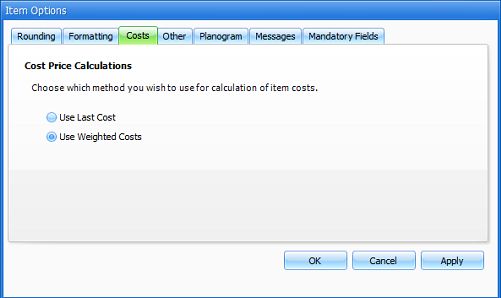

Change the method for item cost

-

Select Tools > Items > Options > Cost.

-

Select the method you want to use.

The default option is Use Last Cost.

-

Select OK.

If you change the cost method, you also need to restart the Fred Office Services. The easiest way to do this is by restarting the Computer that stores the Fred Office data. Contact Fred Help Desk if you need assistance with completing this change.

What is Last Cost?

Last cost is the cost at last received invoices.

The cost will be updated to reflect the unit price on the last invoice.

What is Weighted Cost?

Weighted Cost is a calculation of the cost price of the item taking into account the quantity of the item that has been ordered at different costs.

Formula for calculating the Weighted Cost for an item

Weighted Cost = Total Cost / (Current QOH + Qty Received)

Total Cost = (Current QOH x Current Weighted Cost) + (Qty Received x Invoice Cost)

Example of Weighted Cost calculation

Calculate the Weighted Cost, for the following:

-

An item has a current Quantity On Hand= 10

-

An item has a current Weighted Cost = $20.00

-

The quantity received in a new order = 20

-

The Invoice Cost = $16.00

First, calculate the Total Cost:

| Total Cost = |

(Current QOH x Current Weighted Cost) + (Qty Received x Invoice Cost) (10 x 20.00) + (20 x16.00) 520 |

Next, calculate the Weighted Cost:

| Weighted

Cost = |

Total Cost / (Current QOH + Qty Received) 520 / (10 + 20) $17.33 |